Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

Credit risk analysis extends beyond credit analysis and is the process that achieves a lender’s goals by weighing the costs and benefits of taking on credit risk .

By balancing the costs and benefits of granting credit, lenders measure, analyze and manage risks their business is willing to accept.

The creditworthiness of the borrower, derived from the credit analysis process , is not the only risk lenders face. When granting credit , lenders also consider potential losses from non-performance, such as missed payments and potential bad debt. With such risks come costs, so lenders weigh them against anticipated benefits such as risk-adjusted return on capital (RAROC).

Credit risk analysis aims to take on an acceptable level of risk to advance the lenders’ goals . Goals can include profitability, business growth, and qualitative factors. Management crafts policies that drive their business to achieve its goals.

Although credit analysis can rate risks and estimate the probability of default, default risk is only one entity-specific risk factor. Lenders consider costs and benefits holistically when determining if the anticipated outcomes are acceptable to their business and financial exposure .

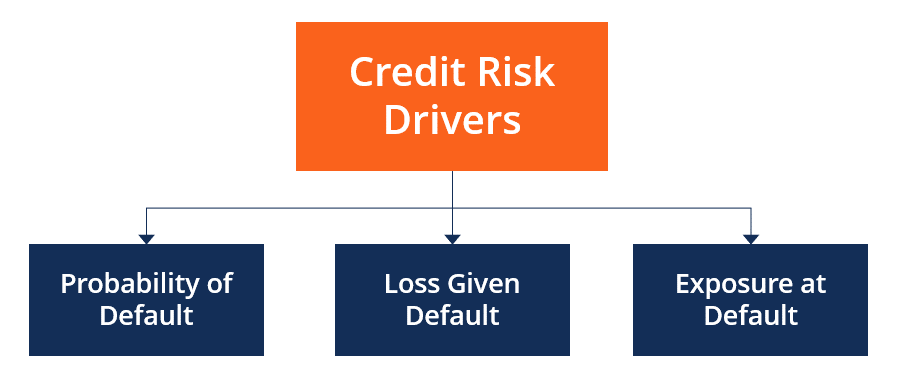

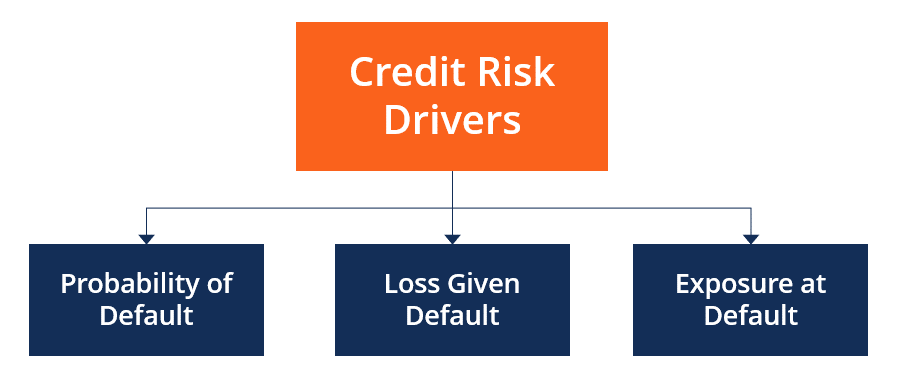

To estimate the cost of risk , lenders employ a multitude of information from the borrower, the lender, and external parties such as credit agencies. Some measures, such as credit scores and credit risk analysis models , are tools that allow lenders to estimate their expected loss (EL) via the probability of default (PD) , loss-given default (LGD) , and exposure at default (EAD).

The direct benefit of taking on credit risk is interest, a combination of default risk premium , liquidity premium , and other factors; however, benefits extend beyond interest revenue. For example, lenders may take on additional credit risk to grow a credit portfolio (their asset base), gain market share and expand relationships, or ensure their portfolio achieves an acceptable risk-adjusted return on capital.

Individual outcomes of credit risk analysis include granting credit with specific credit conditions or even approving exceptional credit to borrowers who may not qualify within standard policies. Management’s goal is to mitigate the portfolio credit risks sufficiently to optimize the firm’s accepted risks in aggregate.

For example, credit risk analysis can determine that lending in the absence of financial risk (e.g., cash-secured lending) is still not acceptable, perhaps due to headline risk specific to the borrower’s owner or the industry that the company operates in.

Conversely, credit risk analysis may support lending to a newer business model (i.e., without proven cash flow) as a business strategy to expand relationships and increase exposure to a growing segment.

Credit risk management is a key issue that lenders of all forms must address. BIS [1] has identified three key areas: concentration, credit processes, and market and liquidity-sensitive exposures.

CFI offers the Commercial Banking & Credit Analyst (CBCA)™ program for finance professionals looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant CFI resources below: